ABOUT US

More than 3 years of experience providing a range of specialized services in the administration of digital services

At Modo-Domo our investors seek to create financial legacies that will stand the test of time. As digital asset managers, our focus is on helping investors access the ever-evolving digital economy to build their future in the present.

Successful market strategies

Satisfied investors

Crypto-Fiat Ramps

SERVICES

We put our experience, teams and resources at your disposal.

We understand that the financial market is very volatile and complex, it is necessary to have the experience, advice and guidance of a reliable team, willing to give you the best advice on finances. We tell you a little more about our products.

Trading Bot

Our software allows us to automate our clients’ operations through different types of strategies aimed at providing liquidity at key moments of market volatility. To do this, we implement three strategies that frame our investment models.

Grid Bot

One of the biggest conflicts when facing volatility is in the lack of trends in the financial market. In the current situation we find the best way to take advantage of the lateralizations and ranges of the market. Our system builds liquidity as a market maker in the market ranges to provide constant sales and purchases.

DCA Bot

At Modo-Domo we believe that the dollar cost average is one of the most profitable long-term strategies in the market that allows the investor to progressively reduce market volatility with fractional purchases that allow a better average market entry.

Mesa OTC

We carry out Over The Counter operations to provide liquidity to any institutional client that needs to operate digital assets, closing the market without affecting the price of the exchanges.

TEAM CONSULTING

Teamwork is an important resource in capital management. Given the synergy of ideas and products by our specialists, we always seek to obtain results according to the criteria of risk and investment.

OUR ONBOARDING

We analyze the profile of each of our investors before entering.

We remember that every investment has a risk, therefore we work with a risk directly proportional to the risk of our clients. Likewise, the higher the risk, the better rewards and risks in it.

01

We analyze the market

02

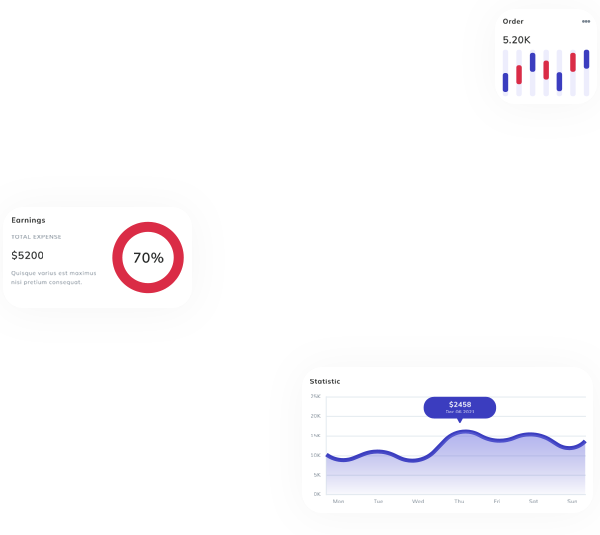

We review the statistics

03

We study the risks

04

We generate proposals

Our recent work supports us in continuing to help our investors.

When we talk about developing comprehensive solutions, we always seek to create a financial product that suits the customer’s sharp and their allocation times.

investments

We generate multiple investment opportunities adjusted to your profile

We allow our investors to have exposure in the NON FUNGIBLE TOKENS. We use fractional tokenization providers like NFTX for low capital investors who need exposure to high rarity pieces like Crypto Punks or Bored Apes!

Finding liquidity is one of the most complex tasks in MODO-DOMO. We understand the need to have exposure to different exchange houses is very important, which is why we use liquidity aggregators that allow us to trigger orders to the market against the best price of the moment.

From the company we consider it very important to have exposure to disruptive investment instruments that allow us to take a further step towards WEB 3.0 where communities and brand activations are created that allow the creation of new digital economies where virtual property takes on an even more important game.

When we talk about stacking, we refer to providing custody service for digital assets of the type (Proof of Stake). In this service we allow users to invest in safe positions without movement of funds. Internally, our structure of nodes and storage of valuable information is managed through decentralized storage such as IPFS, to allow any investor to have the possibility of accessing the crypto ecosystem safely.